Understanding Personal Loans for Bad Credit: On-line Instant Approval …

페이지 정보

본문

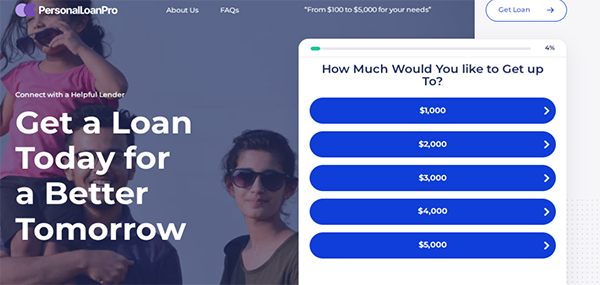

In right now's monetary panorama, personal loans have develop into a well-liked choice for individuals searching for fast entry to funds. Nevertheless, for these with dangerous credit, securing a loan can usually feel like an uphill battle. Happily, the rise of online lending platforms has introduced new opportunities for people with less-than-perfect credit score scores to acquire personal loans with on the spot approval. This article will discover what personal loans for bad credit are, how they work, the benefits and disadvantages, and tips on how to enhance your chances of approval.

What Are Personal Loans for Bad Credit?

Personal loans are unsecured loans that can be used for various purposes, together with debt consolidation, medical bills, residence improvements, or unexpected emergencies. For people with unhealthy credit—typically outlined as a credit score score under 580—finding a lender willing to approve their loan software may be difficult. However, many online lenders focus on providing personal loans to these with poor credit score histories.

How Do Online Personal Loans Work?

Online personal loans for bad credit instant approval online loans for bad credit personal loans guaranteed approval 10000 credit sometimes comply with a easy software course of:

- Utility: Borrowers fill out an online application kind, offering private data, financial details, and the amount they want to borrow.

- Credit Examine: Lenders may carry out a comfortable or arduous credit inquiry to assess the applicant's creditworthiness. Some lenders may not require a credit score examine at all, relying instead on different factors like revenue and employment history.

- Approval: If the application meets the lender’s standards, the borrower receives an instantaneous approval notification. This course of can take as little as a few minutes.

- Funding: Once accepted, the lender will disburse the funds, often within one enterprise day. The money may be deposited straight into the borrower’s bank account.

Advantages of Online Personal Loans for Bad Credit

- Quick Entry to Funds: Online lenders typically provide immediate approval and quick funding, making them an excellent option for emergencies the place time is of the essence.

- Less Stringent Requirements: Many online lenders are more flexible with their lending standards in comparison with traditional banks. They could consider components past credit scores, akin to income and employment standing.

- Convenience: Your complete process, from application to funding, may be accomplished online, allowing borrowers to use from the consolation of their houses with out the need for in-person visits.

- Number of Options: Borrowers can evaluate multiple lenders and loan presents simply, enabling them to seek out phrases that best swimsuit their monetary scenario.

Disadvantages of Online Personal Loans for Bad Credit

- Larger Curiosity Charges: Borrowers with bad credit often face higher interest charges in comparison with these with good credit. This can result in increased overall repayment quantities.

- Shorter Loan Terms: Some on-line lenders may supply shorter repayment intervals, which may end up in higher monthly funds.

- Potential for Scams: The rise of on-line lending has additionally led to an increase in predatory lending practices. In case you have virtually any concerns relating to in which along with the way to use secured personal loan with bad credit history, you are able to email us with our own webpage. Borrowers should be cautious and ensure they are working with reputable lenders.

- Restricted Loan Quantities: Lenders might restrict the sum of money available to borrowers with unhealthy credit score, which can not meet their monetary needs.

Tips for Improving Your Possibilities of Approval

- Test Your Credit score Report: Before applying for a loan, overview your credit report for errors or inaccuracies. Disputing incorrect information can assist enhance your credit score.

- Consider a Co-Signer: If potential, having a co-signer with better credit can increase your possibilities of approval and may even make it easier to safe a lower curiosity charge.

- Exhibit Stable Income: Lenders usually tend to approve loans for people with a steady income. Providing proof of employment and income can strengthen your application.

- Borrow Only What You Want: Requesting a smaller loan amount can improve your chances of approval and make it easier to handle repayments.

- Research Lenders: Take the time to check different lenders and their phrases. Look for lenders that specialize in bad credit loans and skim reviews from previous borrowers.

- Avoid A number of Applications: Submitting a number of loan functions in a brief period can negatively impression your credit rating. As an alternative, deal with one or two lenders that you simply believe are prone to approve your utility.

Conclusion

Personal loans for bad credit with online instantaneous approval can be a lifeline for people facing monetary challenges. Whereas these loans provide quick entry to funds and a extra lenient application process, borrowers should bear in mind of the potential pitfalls, together with larger curiosity rates and the risk of predatory lending practices. By understanding how these loans work and taking proactive steps to enhance their creditworthiness, individuals can navigate the lending landscape more effectively and discover the financial help they want. Always conduct thorough analysis and consider all choices before making a choice to make sure that you make your best option for your financial future.

- 이전글Understanding Small Emergency Loans No Credit Check: A Comprehensive Guide 25.09.13

- 다음글Revolutionizing Luxurious Travel: The Subsequent Generation Of Private Jet Trips 25.09.13

댓글목록

등록된 댓글이 없습니다.